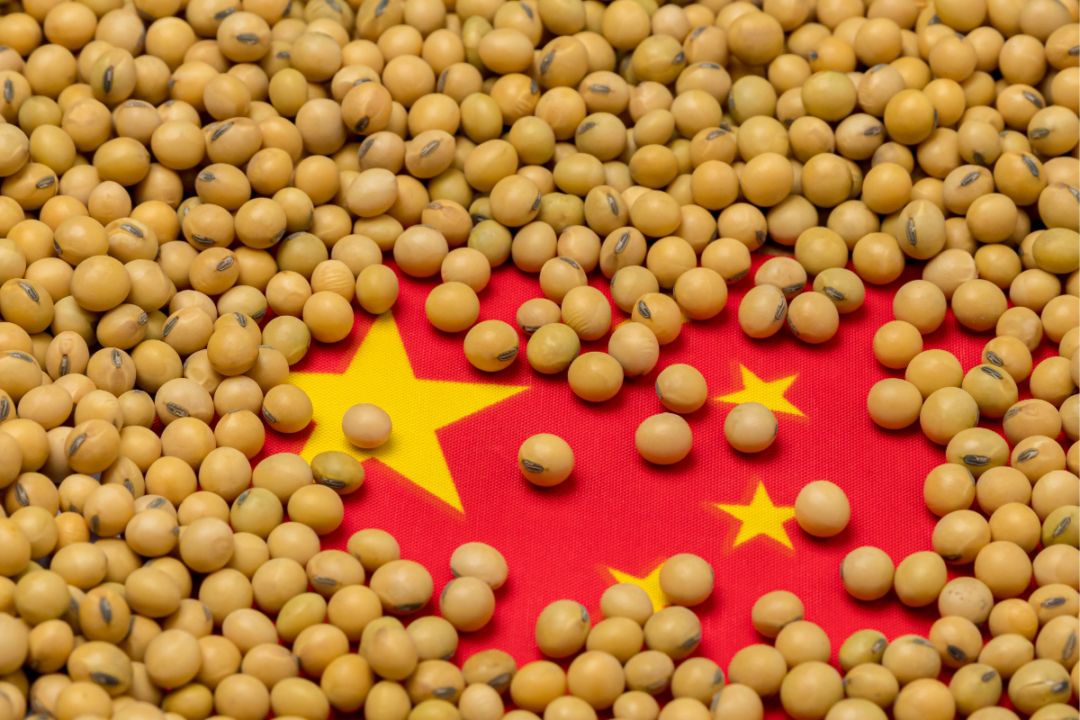

Prices for soybeans and soybean meal in China rose after the introduction of mirror 10-15% tariffs on agricultural products from the US

In response to US President D. Trump's increase in import duties on Chinese goods from 10% to 20% (added to the previously established 20%), China will impose tariffs on US products from March 10, 2025, in particular 15% on chicken, wheat and corn, and 10% on soybeans, pork, beef, fruits, vegetables and dairy products. 💡 China has halted imports from three U.S. exporters after imposing new restrictions. According to Barchart, the U.S. still has 1.569 million tons of soybeans contracted but not yet shipped to China. 📈 Chinese soybean #meal prices rose nearly 3% to a three-week high amid a renewed trade war, with disruptions to U.S. soybean supplies likely exacerbating the market situation. 📈 According to OleoScope, on February 28, 2025, the price of soybeans in China (Dalian) for February delivery increased by $25.19/t from $546.15/t to a weekly high of $571.35/t, and soybean meal (Dalian) increased by $48.2/t from $435.27/t to $483.47/t compared to the previous day. 💡 According to the China National Grain and Oilseed Information Center (CNGOIC), during the last week of February, soybean stocks in China fell to 4.57 million tons due to increased processing volumes and positive margins. 🇨🇳 China responded to Trump's first tariff hikes in February by imposing tariffs on American metals, liquefied natural gas and farm equipment, but agricultural products were not affected. During Trump's previous presidency, Beijing had already imposed high tariffs on US agricultural goods, particularly soybeans, which led to an 80% drop in US soybean exports to China in two years as China began buying more soybeans from Brazil. 🔎 As of the end of January 2025, US export sales to China accounted for only 47% of total shipments, the lowest level in 17 years (excluding the period of trade tensions during Trump's first term). 🤔 China typically buys soybeans from the US in the first half of the season, switching to supplies from Brazil in January. However, this year, due to a delayed harvest in Brazil and the cessation of supplies from the US, a short-term price increase is expected, which will end when a record Brazilian crop enters the market.